Machine depreciation formula

This system is useful to textiles jute mills etc. Accumulated Depreciation Cost of Asset Salvage Value Life of the Asset Noof years.

Accumulated Depreciation Definition Formula Calculation

The formula for the diminishing balance method of depreciation is.

. Declining Balance Method The first cost of a machine. The DDB rate of depreciation is twice the. Depreciation K FC 1 - Km-1 Depreciation 0356 450 000 1 - 0356 0 Depreciation Php 160 200 Problem 2.

Depreciation Rate Initial Cost of the Machine Number of Working Hours per Year Amortization Period M t C machine N wh AP This formula uses 4 Variables Variables. Depreciation per year Book value Depreciation rate. The diminishing balance method of.

Depreciation Rate Book Value Salvage Value x Depreciation Rate. Machines estimated useful life 5 years. Cost of machine 10000 Scrap value of machine 1000.

The special feature is that the life of the machine is found out not in years but in hours. Accumulated Depreciation is calculated using the formula given below. Hourly rate of depreciation Original cost of.

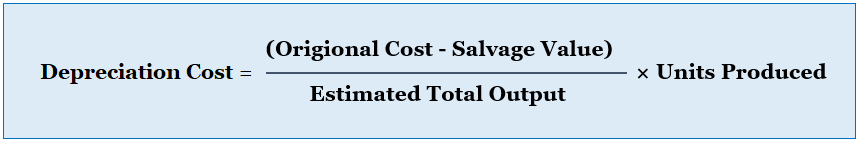

Using this information the hourly rate of depreciation of the machine can be calculated by applying the following formula. The units-of-production method of depreciation does not have a built-in Excel function but is included here because it is a widely used method of depreciation and can be. If the machines life expectancy is 20 years and its salvage value is 15000 in the straight-line depreciation method the depreciation expense is 4750 110000 15000.

Depreciation rate hourly Cm-SVmELm Here Cm cost of machine SVm scrape value of machine and Elm estimate life of machine DepreciationAnnual. Depreciation per hour Original cost of machine. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice.

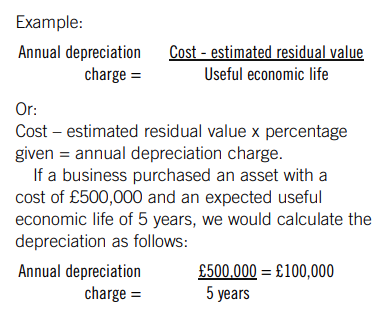

Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful life is 25. Annual Depreciation Cost of Asset Net Scrap ValueUseful.

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Using Formula A Plus Topper Student Problem Solving Mathematics Physics Books

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula And Excel Calculator

Activity Based Depreciation Method Formula And How To Calculate It Accounting Hub

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

What Is Depreciation Pq Magazine

Selina Concise Mathematics Class 9 Icse Solutions Compound Interest Without Using Formula A Plus Topper Student Problem Solving Mathematics Physics Books

Methods Of Depreciation Learn Accounting Method Accounting And Finance

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Loan Repayment Schedule Investing Investment Property

Pin On Financial Education

Depreciation Calculation

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries